Introduction

The word ‘loan’ evokes mixed interests in the minds of Indian people. Some are more comfortable with the idea of a loan, while others get slightly nervous when it is brought up.

Irrespective of whether you are satisfied with it or not, you cannot ignore the fact that a loan is the most popular instrument that you can avail to give shape to your dreams.

The most common reasons why some people stay away from loans are recurring monthly is the concept of having liability, and the high rates of interest that come with loans. But, if you use a home loan EMI calculator correctly, you can stay sure that your housing loan EMI never becomes a cause for botheration.

Recommended reading: Personal Loan Helpful in Every Stage of Your Life

5 reasons to use a home loan EMI calculator

This article equips you with everything you want to know about a home loan EMI calculator and how using it correctly can ensure you get the maximum benefits out of a housing loan.

1. It Helps You Choose the Lender Who is Offering the Best Interest Rates

The Indian home loan industry is more competitive than most of us realize. As a result, you can get the best interest rates if you search correctly. By using the home loan calculator, you can get an idea about your eligibility, loan amount, interest rates, documents required, tenure, down payment, and other details.

Hence, a housing loan calculator helps you to identify the lender who is offering the best terms.

2. It Helps You Restructure Your Finances

A lender takes into account your debt-to-income ratio and monthly liabilities before finalizing the housing loan amount. As a home loan calculator gives you a detailed overview of the EMI amount, you can restructure your finances, including existing debt, to increase the loan amount.

Recommended reading: 10 hacks to get a business loan to your small biz

Generally, you may get up to 90% of the property’s value as a loan. You require to pay 10% of the property’s value as downpayment, though. If you know the EMI amount in advance, it will help you to recalculate or increase the downpayment amount, which will bring down the EMI you pay monthly.

3. It Helps You to Know Your Tax Savings

A housing loan is an excellent medium to save taxes. You may save up to INR 1.5 lakh on the principal loan amount and up to INR 2 lakh on the loan interest. As a home loan EMI calculator gives you an accurate estimate of the amount that you can avail of, you can calculate the tax savings even before the financial year commences. You may spend the amount saved in this process on other productive activities.

Recommended reading: A Career in Private Equity

4. It is Easy to Use

Gone are the days when you had to visit the lending institution multiple times and wait for hours to meet the executive, to know the rates. You may get three types of home loan EMI calculators online – EMI Calculator, Eligibility Calculator, and Affordability Calculator.

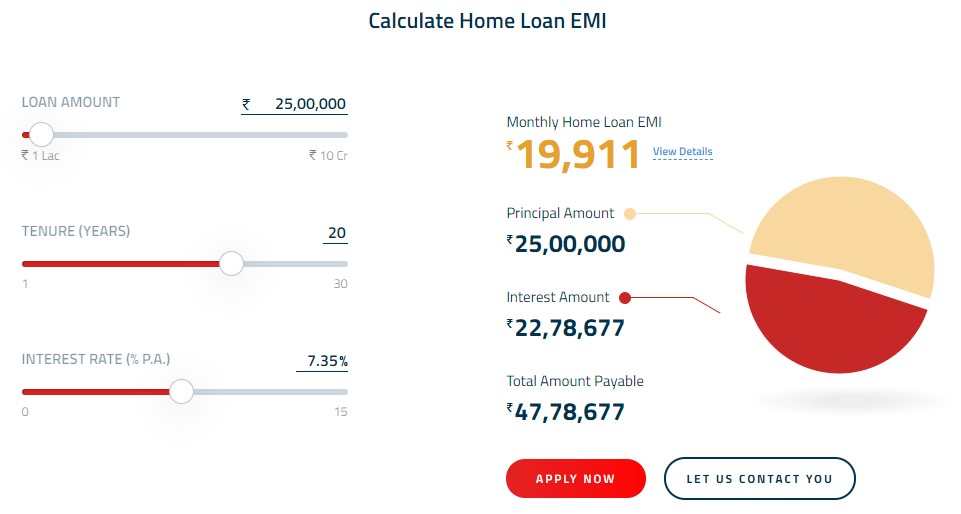

- To know the EMI, you have to enter the loan amount, ROI, and tenure.

- To see the eligibility, you have to enter your gross monthly income, tenure, ROI, and other EMI details.

- To know the loan amount, enter downpayment amount, total monthly income, loan tenure, ROI, and other EMI details in the affordability calculator.

5. It Helps You to Choose the Right Tenure

A home loan calculator helps you to adjust the loan tenure according to the EMI amount. If you feel you can pay the loan early, reduce the mandate. If, however, you have other obligations, choose a longer tenure.

Conclusion

Housing loan is probably the best way to fulfil your dreams. A home loan calculator makes the task easier.

This post was created with our nice and easy submission form. Create your post!